ESTABLISH GENERAL AID GUARANTEE OF $1000 PER PUPIL

Under the proposal, no public school district would receive less than $1,000 per pupil in equalization aid and special adjustment aid.

FISCAL IMPACT OF $1000 PER PUPIL GENERAL AID GUARANTEE

In the 2021-22 fiscal year, the 51 school districts that received less than $1,000 per pupil in net general aid (equalization aid and special adjustment aid) had combined aid payments totaling $7.5 million. Had the $1,000 per pupil general aid guarantee been in effect, these 51 resort-area and suburban school districts would have received a combined net general aid increase of $20.7 million, or 0.4% of total net general aid payments of $4.95 billion. Click here to see the estimated 2021-22 fiscal impact.

Continually Declining General Aid Shift Costs to Local Property Taxpayers

The establishment of a $1,000 per pupil general aid guarantee would prevent the ongoing shift of public education costs in high property value school districts to local property taxpayers. Between 2010-11 and 2021-22, there was a 65.4% reduction in net general aid to the 51 high property value school districts that received less than $1,000 per pupil, from a total $21.6 million to $7.5 million. By comparison, statewide net general aid increased by 10.8%, from $4.47 billion to $4.95 billion.

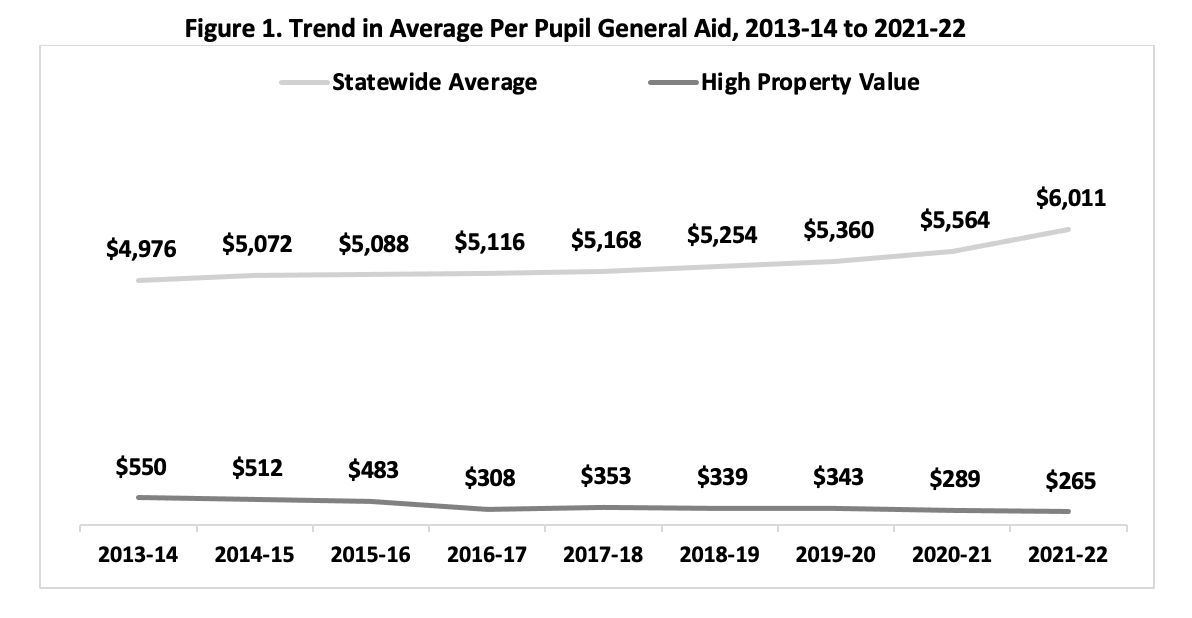

AVERAGE PER PUPIL GENERAL AID, 2013-14 TO 2021-22

From 2013-14 to 2021-22, average per pupil net general aid support for high property value school districts, those receiving less than $1,000 per pupil, decreased by 51.8%, from $550 to $265. Meanwhile, statewide average per pupil general aid payments increased by 20.8%, from $4,976 to $6,011, as shown in Figure 1 (on the right).

Continually declining general aid is contrary to the statutory purpose of the state school aid formula [1] to cause the state to assume a greater proportion of the costs of public education and to relieve the general property of some of its tax burden.

According to the Wisconsin Legislative Council, the provision of a minimum funding floor in addition to the constitutionally required educational opportunity floor would increase the uniformity of the state school funding system. Click here for aid comparison printout. [1] Purpose of General Aid: Wisconsin Legislature: 121.01

Disproportionate Impact on Taxpayers in Resort Area School Districts

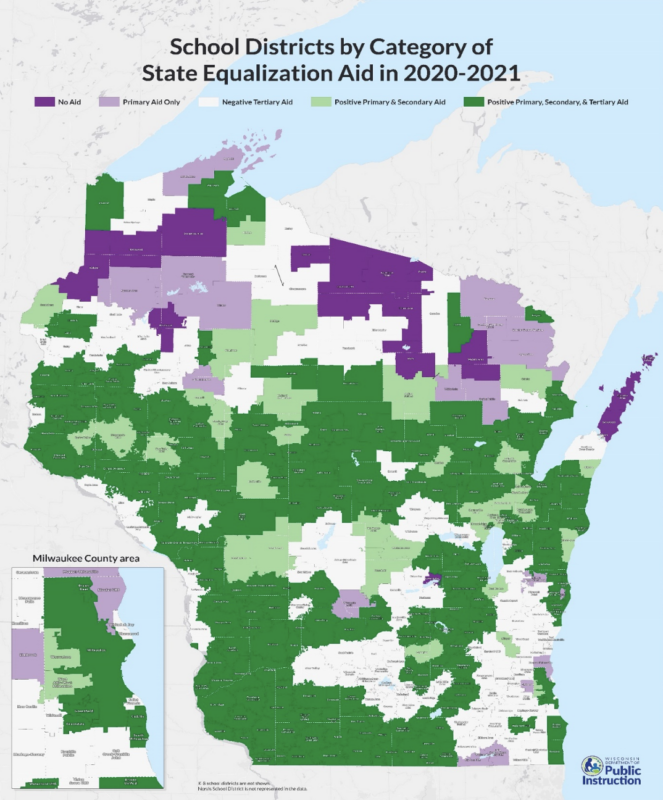

“No Aid” and “Primary Aid Only” high property value school districts are disproportionately located in resort areas of the state where tourism is a main driver of the local economy, as shown on the Department of Public Instruction’s State Equalization Aid map to the left.

“No aid” districts, shown in dark purple, are ineligible for equalization aid because their per pupil property value exceeds the equalization aid formula’s $1,930,000 primary guaranteed valuation. In 2021-22, four school districts – North Lakeland, Geneva J4, Mercer, and Washington Island – are zero aid districts.

This means they no longer even receive special adjustment aid, which is meant to mitigate severe declines in aid by limiting the aid loss to 15 percent a year (ensuring the district gets at least 85 percent of the previous year’s eligibility).